Before you start a trading business on eBay, it is significant to acknowledge all the eBay policies. These policies mainly concern sellers and their per item sold. To begin with, eBay likewise, any other third-party online website, covers its cost of business. It does so via taking a commission from traders or sellers per item sold on the respective site. Indeed, sites like eBay act as a broker between buyer and seller. But, when it comes to the subject of “what percentage does eBay take?” the answer to this can be a little complex to understand.

For the most part, the eBay selling fees calculator is available to get a quick view of the eBay final value fees by category. However, other factors such as eBay store fees and PayPal also play an essential role in this calculation. Hence, before you go ahead and learn what percentage eBay takes in 2020, let’s take a glimpse of when eBay charges fees and why?

Table of Contents

Disclaimer:

Recently, on 18th July 2020, eBay has upgraded its fee structure concerning its sellers. Therefore, if you face any difficulties understanding the deductions of selling charges in your eBay seller’s account, this reading will help you resolve the confusion.

What percentage and When does eBay Charge as fees?

For the reader’s information, eBay charges its sellers two times per item. According to the advanced policy of eBay and compensation, it costs both the insertion fees and final value fees in order to fulfill its potential profit margin per item on eBay. In this case, sellers on eBay seem like a victim of money laundering. However, that’s not it.

As mentioned before, eBay is one of the largest online monopolistic markets that serves both buyers and sellers at an equal level. On the one hand, sellers easily find customers for their products on the shelves of their store for long enough. On the other hand, customers easily find first, second, or even third-hand products in need on eBay. Not only this, but a customer also skips from one seller to another in order to fit the budget timeline.

In this way, both buyers and sellers enjoy a list of distinctive benefits on eBay. In return, eBay charges for serving the sellers with unlimited access to potential customers and online revenue-generating opportunities.

Now, there are two types of fees charged by eBay.

Insertion Fees

This fee also refers to “item listing fees.” When a seller on eBay lists items for sale, eBay charges the seller with a small fee.

Nowadays, eBay is serving its new sellers with zero insertion fee allowance. This allowance is used by sellers to list specific items on eBay stores for sales without any obligation to pay insertion fees for those items. However, how many zero insertion fee allowance you get depends on your eBay subscription package!

Final Value Fees

Apart from the insertion fee or item listing fee, eBay also charges final value fees when the seller successfully sells one or more than one item on eBay. What Percentage does eBay take? – you will learn next!

Despite these two types of fees charged by eBay, you may also come across additional fees such as the payments processing fees, subtitle listing fees, multiple category listing fees, and so on. Hence, stay tuned with us to know all about it.

What Percentage does eBay take?

eBay fees are specific for different items belonging to different categories. Hence, we are presenting a list of eBay final value fees by category to help you understand swiftly.

For General Categories – Automotive Tools & Supplies, Motors, Motor Accessories and Music & Records

Items that fall in the above categories remain applicable for 10% final value fees. eBay has also set maximum final value fees for such categories. It is $750 per month. Therefore, if you, as a seller, have reached this final value fee limit, you will not be able to make more sales in the respective month.

Moreover, insertion fees for these categories are only $.35 per listing (a.k.a per item). You also get 50 free listings in the first month of joining the eBay Store.

Heavy Equipment, commercial printing presses, and food trucks, trailers, and carts

Items that fall in the above categories remain applicable for 2% final value fees. Thus, if you sell a piece of heavy equipment for $200, eBay will charge you $4 as final value fees. However, insertion fees for such categories are high – $20 per item.

For Books, DVDs, Music, and Movies

The above categories remain applicable for 12% final value fees. Maximum limit set by Ebay for these categories is $750 per month. This means that you can generate revenue numbered over 8000 USD per month by promoting your products under the given categories. Apart from this, a 0.35 USD insertion fee per item is applicable.

Musical Instruments and Gears

There are “zero” insertion fees for listing Musical Instruments and Gears such as Guitar and basses over the eBay store. Yet, eBay takes 3.5% final value fees with a maximum limit of $750.

Clothing and Footwear

These categories on eBay are divided into two parts: listings with selling cost equivalent to or above $100 and listings with the cost of sale less than $100.

First, eBay charges no insertion and final value fees if the cost per item is equal to or more than $100. If your items in these categories do not fulfill this condition, 10% final value fees remain applicable.

In simple words, when you list any product on eBay 2020 Store for sales, it will not take more than 12% of the sales value in the form of commission. But, as mentioned before, what percentage does eBay take and how many additional charges does eBay take – are two different subjects. So, let’s find out about the latter one.

What percentage does eBay take for additional services?

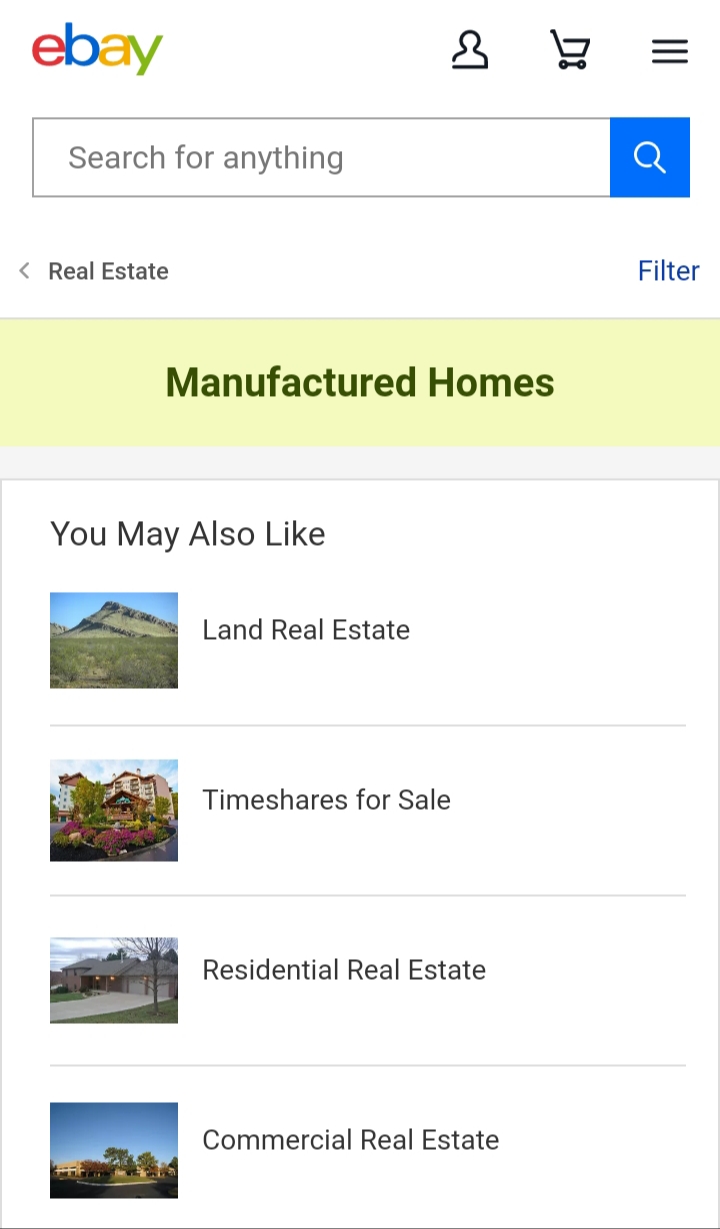

In the past few years, eBay has also started to embrace the online real estate industry by allowing real estate agents to promote property and land sales. Real estate agents can list commercial buildings, land, timeshare, and manufactured homes. However, Ebay’s insertion fee and notice fee for the property are a bit higher. Also, the eBay selling fees calculator works differently when it comes to managing the sales of property and land on the respective site. At last, eBay also considers other factors, such as the seller’s performance, auction-style, and duration.

What percentage does Ebay take for Land, manufactured, and timeshare homes?

Property Auctioned for up to 10 days of listing, eBay charges $35 insertion fees as well as notice fees.

Land or property auctioned for up to 30 days of listing, eBay charges $50 insertion and $35 notice fees.

Land and property promotion through classified ads for 30 days, eBay charges $150 as listing fees. You can also list it for 90 days for an additional $150, i.e., a total insertion fee of $300.

What percentage does Ebay take for Commercial, residential, and other real estate?

eBay takes $100 insertion fees for Real Estate listing under the Auction Style category up to 10 days. On the other hand, 30-days auction-style or fixed priced commercial and residential property listing costs $150.

Above all, a listing of commercial and residential property under classified Ads category costs $150 for 30 days and 300 USD for 90 days with zero notice fees.

By definition, a notice fee is a type of additional charge that is applicable when a seller does not take off the real estate auctioned property from the site after its listing period is over.

Disclaimer: eBay has also upgraded its Real Estate Policy in July 2020. Therefore, it is highly recommended to go through each policy before adding real estate related ads on the site.

What percentage does eBay take in the form of payment processing fees?

By definition, a “payment processing fee” is a type of additional charge that eBay takes in order to manage and collect payments from buyers on your behalf. In this case, eBay takes complete responsibility of payment-related glitches.

On the other hand, if you set up your PayPal account in order to receive payment from the buyer, then the responsibility of any type of glitches falls on your hands as a seller. Apart from this, it is noteworthy to mention that third-party payment apps such as Paypal and Google Pay will also charge a “payments processing fee” for every item sold on eBay and the received credit for the same.

Ebay and Service Taxes

For now, you have learned about all the charges as well as additional charges that Ebay takes. But, one of the factors that you may have forgotten is – Taxes.

So, to be clear, eBay also charges VAT or Valued Added Tax, GST or Goods and services tax, and other taxes based on the government policy concerning taxes in your country. Apart from this, if you are using eBay services as a seller in another country, all payments will still take place in USD currency. Hence, it is recommendable to consider the currency exchange rate as well as charges for the same in your country via your bank’s home branch.

Epilogue

eBay is now reaching the skies of success in the online business industry. Millions of buyers on eBay find a good match for their requirements on the site. Therefore, as a seller on eBay, you have more scope of running your business successfully than offline. Thus, rethink the idea of quitting eBay because of additional charges because the crowd of buyers is there!